Recenzje Plinko Przeczytaj Recenzje Obsługi Klienta Plinko Com

Recenzje Plinko Przeczytaj Recenzje Obsługi Klienta Pli […]

Mortgage rates of interest was informed me into the HSH’s earlier article. This site contours charge that may connect with home collateral finance and you can house security personal lines of credit (HELOCs) and you can discusses this new taxation effects of utilizing your residence security.

Since the a property collateral loan or credit line is good variety of next home loan, you will spend many fees like the individuals your paid back payday loans Odenville when you had very first mortgage. However, any commission-depending charges are straight down since mortgage wide variety toward second liens are usually smaller compared to to own first mortgages.

Here are a few common charges could be recharged after you tap to your home collateral using financing otherwise house collateral range off borrowing from the bank:

1. Factors. Fund, such as the old repaired-rate 2nd financial, may charge things. Each point, comparable to one percent of your own loan amount, can merely total up to several or thousands of dollars, based upon simply how much you acquire. Since detailed, very HELOCs don’t have circumstances, however loan providers could possibly get allows you to shell out points to score a reduced rate of interest.

If the readily available, spending points helps make experience in a few affairs. If, such as for instance, you are taking out a giant line of credit that will bring years to expend back, you could need to envision paying men and women factors to get that down rate of interest. Over the years, your all the way down rate of interest (and lower monthly premiums) is to offset the cost of the new products. Purchasing items toward a small line, otherwise you to definitely you intend to invest back rapidly, may well not save anything eventually.

Keep in mind that whilst you ount, the lender can sometimes charges facts toward maximum line you is ever obtain. When you need to borrow $twenty-five,000, eg, but your maximum possible line try $80,000, you could feel charged facts towards $80,000 — even although you will most likely not obtain all of that money. Check out the following the, centered on a twenty five-season name, where you pay a couple of factors to get the straight down rate of interest:

Having an effective $twenty-five difference in the latest payment, you have shielded the price of items in approximately five years, and can beginning to spend less afterwards. This example takes on the prices never ever change; they, however the relative deals would be equal. Which is true for a smaller line; but not, it raises the level of out-of-wallet debts to possess the lowest deals in the payment — about $20 30 days towards the a great $20,000 line.

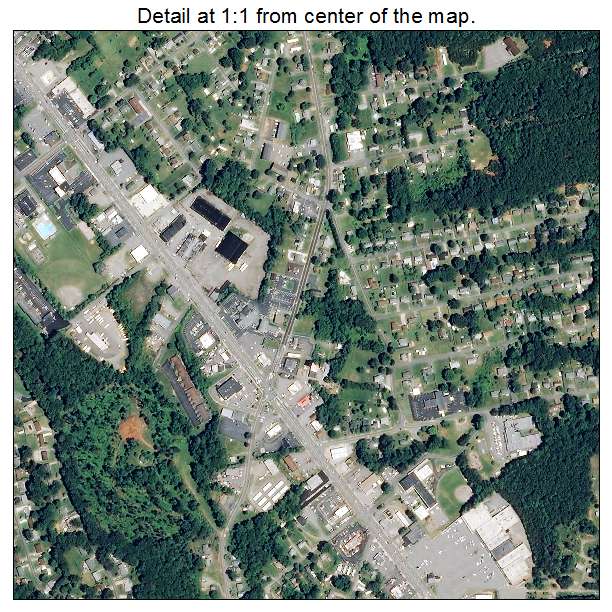

2. Appraisal. Extremely loan providers require some style of property assessment to decide merely how much the home is definitely worth. Certain loan providers, especially in those people regions of the nation in which property philosophy haven’t changed much, need only an excellent ‘drive-by’ assessment — simply a simple glance at the property’s additional standing and also the people it is based in. Much more, loan providers are utilizing “automatic valuation designs” (AVMs) to determine a functional worth for your house and simply want an actual assessment if you are looking so you’re able to faucet a good amount of security. In some components, although not, loan providers require a full appraisal, accomplished by a specialist appraisal firm. Whenever you are drive-from the appraisals and you may AVM opinions normally have zero will cost you enacted together to you personally, the full assessment can cost doing $3 hundred or maybe more.

3. Credit assessment. Another commission to expect is actually for a credit check; always $31 so you’re able to $50. Like with very first mortgage loans, your credit rating can be used to determine what prices and charge shall be available to you, if any. The credit score is frequently taken from 1 (or maybe more) of your own significant credit bureaus, particularly FICO otherwise VantageScore, however, loan providers can use other designs from Experian, TransUnion otherwise Equifax if you don’t their unique design. Whatever the design operating, these are regularly legal your earlier in the day history of addressing credit plus determination to settle. Undesirable scratching otherwise down score shouldn’t be a great roadblock to getting your property equity mortgage otherwise line, since you are pledging a safety — your residence — against what you can do to settle, even so they ount, reduced label otherwise particular blend of these types of.

Recenzje Plinko Przeczytaj Recenzje Obsługi Klienta Pli […]

Table of Contents Tyson Fury vs. Oleksandr Usyk – […]

Оперативні та актуальні новини України на сайті korvest […]

Содержимое Вход на Мостбет: зеркало, VPN, анонимайзеры […]