Recenzje Plinko Przeczytaj Recenzje Obsługi Klienta Plinko Com

Recenzje Plinko Przeczytaj Recenzje Obsługi Klienta Pli […]

Regarding societal and private nonprofit education, California’s families obtain large wide variety however, frequently compensate for they with repayment activities that provide all of them closer to this new national imply. Source: Author’s studies of information on College Scorecard institution-top dataset, via the U.S. Company off Training. Find Shape 37 regarding the spouse declaration . “> 65 (Select Profile ten.) Reduced very for Parent And finance lent for to have-funds degree; among families you to lent Father or mother Also to possess a concerning-profit college, the common financing balance try forty-five percent large during the Ca than just other You certainly one of household that were for the fees for starters year, and you will 56 percent getting parents that were in the fees getting 5 years. Ibid. “> 66

It is distinguished and surprising one Ca try a talked about circumstances away from higher loans burdens for attending to have-winnings, considering the inexpensive available options in order to California’s family with regards to county educational funding and you can neighborhood expenses waivers. This type of designs in addition to reveal exactly how borrowing to attend to possess-profits is also adversely change the moms and dads of your students that attend all of them, just the students just who sign up.

A graduate-level studies, eg a beneficial master’s or doctoral education, pulls the majority of people trying move on in their occupation. More advanced experiences from the team work for society, however, policymakers need grapple into the enough time-label monetary effects of this loans for family along with the new different affects because of the battle and you can classification record.

Because of the complete loan amount, graduate children were the majority of yearly borrowing within the Ca, position California certainly certainly one of simply three states (along with Puerto Rico and Washington, D.C.) in which graduate mortgage applications contribute over fifty percent of all of the loan cash paid a year. Ibid. “> 71

Inside California’s scholar financial obligation, about the style emerge. Among to possess-cash colleges, the average yearly Grad And additionally financing within the California try $30,600, that’s 43% more than the average among to own-payouts about rest of the Us. Source: author’s analysis of data from the Federal College student Support Studies Center. Come across Shape one in the new lover report . “> 72 Among individual nonprofit colleges, yearly Grad Plus loans was highest, averaging $33,2 hundred per year within the California, nevertheless the gap between Ca and also the remaining portion of the United States is a lot faster (eleven per cent). Just on the having-cash market create Stafford graduate finance in Ca exceed those who work in the rest of the Us from the a meaningful margin, at 27 percent.

Into cohort away from consumers who had been during the fees to own five years towards a graduate financing regarding an as-profit school, California borrowers’ average mortgage equilibrium try $81,600, that’s more than twice as much average on to own-earnings cohort about remaining You.

Study with the attainment and you will money make sure the official benefit leaves a premium with the postsecondary education, highlighting an economy very stratified according to workers’ degree levels:

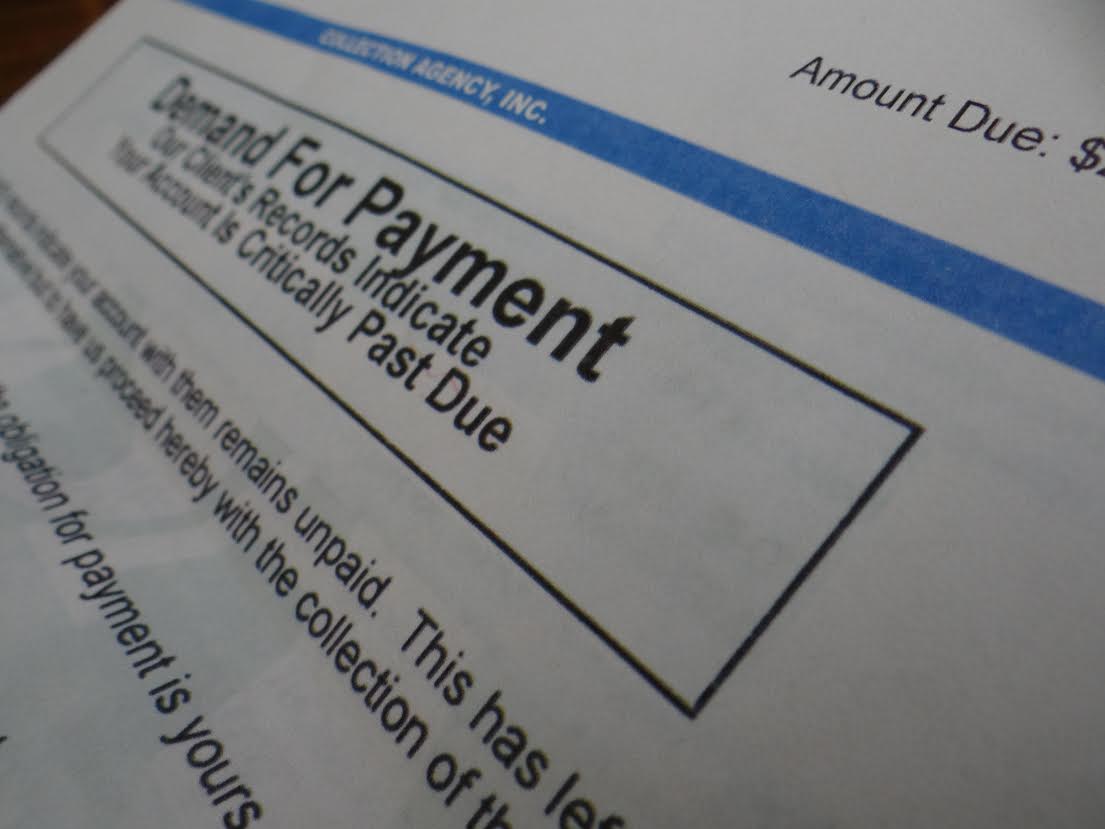

A savings noted of the for example inequality can make a guy end up being particularly upgrading brand new hierarchy is really worth people costs. Enter into Also funds, which will actually protection people rates in the event your debtor allows all of them.

Regrettably, not all whom go after a degree sooner or later get highest revenues, in addition they will get challenge within the cost. Graduate And loans are eligible to have money-passionate cost (IDR), the latest government education loan installment plan that is very amenable to borrowers that have lowest profits. Starting to be more California borrowers toward IDR agreements try a state top priority detailed on CSAC Education loan and Debt Service Feedback Workgroup’s latest report, and you will Grad Also individuals in particular manage make use of IDR. But not, Father or mother In addition to is not qualified to receive IDR, and come up with these types of bad credit installment loans Washington finance specifically hazardous to possess mothers rather than solid financial resources. Father or mother Along with finance perspective an exceptionally thorny personal coverage question, once the condition lawmakers dont seek out the strategy off enrolling a great deal more mother-consumers towards IDR.

Recenzje Plinko Przeczytaj Recenzje Obsługi Klienta Pli […]

Table of Contents Tyson Fury vs. Oleksandr Usyk – […]

Оперативні та актуальні новини України на сайті korvest […]

ข้อมูลทั่วไป iPhone 5S Vs iPhone 5c ทั้งสเปคและราคา เหม […]