BETKOM – Betkom Casino Giriş Adresi ve Resmi

Содержимое BETKOM Casino’ya Nasıl Girilir? 1. BET […]

In an income statement, “sales” is classified as a revenue account and is posted as a credit entry in a double-entry bookkeeping system. If no sales returns and allowances account is there, the revenue reversal entries will be different (as shown below). Some companies do not use the contra-account for the purpose of sales return. Instead, they debit the sales account directly and credit accounts receivable or cash.

Revenues are what businesses earn through selling their products to their customers while expenses are what businesses spend in the course of running their operations. For most businesses, the sales revenue that comes from their main operation is the main source of their revenues. Since expenses are usually increasing, think “debit” when expenses are incurred. Debit the accounts receivable account in a journal entry in your records by the full invoice amount of a sale before a cash discount. Credit the sales revenue account by the same amount in the same journal entry.

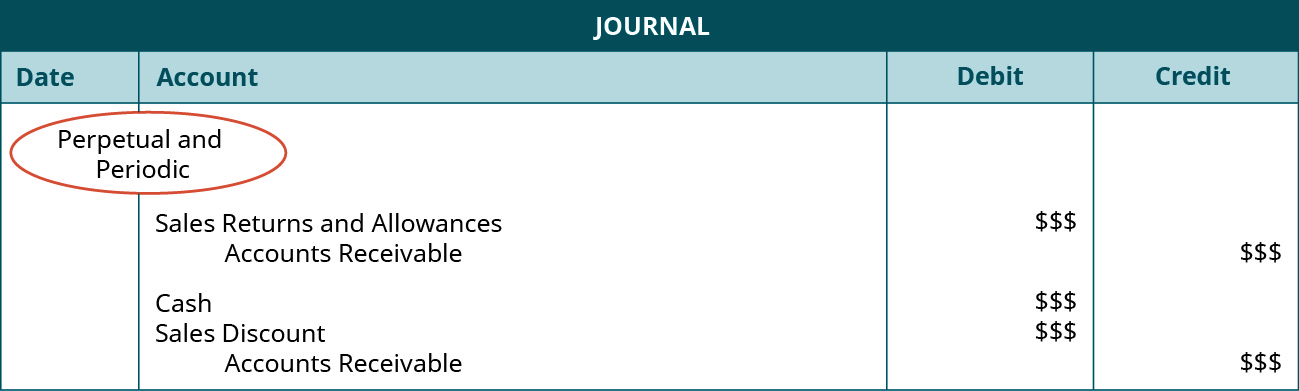

Recording sales returns and allowance is straightforward after knowing their accounting treatment. However, it is crucial to understand how companies account for their sales first. When a company sells a product or service to a customer, it will use the journal entries below. Therefore, when sales returns and allowances occur, companies have already recorded sales in the accounts. The accounting treatment of sales returns and allowances occurs after this period. Therefore, companies must account for them as a reduction in sales rather than credit the account with the amount.

This is usually the case where customers return goods due to they are damaged or defective. In this circumstance, the sales returns and allowances and related accounts are recorded the same as above journal entry. Sales returns and allowances is a contra revenue account with a normal debit balance used to record returns from and allowances to customers.

These two journal entries complete the accounting process required in the books of the seller for the return of merchandise. If your customer uses a credit card to buy the item, you’ll debit accounts receivable instead of cash since it’s income that you’re owed, but you haven’t been paid yet. Accounting for a sales return involves reversing (a) the revenue recorded at the time of original sale, and (b) the related cost of goods sold. Rather than refunding a customer with cash, you might credit merchandise at your business. Accounting for a purchase return with store credit is similar to a cash refund. But instead of entering in your Cash account, you credit your Accounts Payable account.

Suppose a customer bought a leather jacket from Jill, a shop owner, for $300. However, a week later, they returned the jacket, citing problems with its fitting and quality. To indicate that dual posting is necessary, a diagonal line is drawn in the P.R. The seller usually issues matching principle definition the customer a credit memorandum showing the amount of credit granted and the reason for the return. On 5th Feb 2020, the customer returned 5 pieces of product Y and 6 pieces of product Z to ABC cosmetics. Now we have to deal with inventory/goods that customers just returned.

To close these debit balance accounts, a credit is required with a corresponding debit to the income summary. “Temporary accounts” (or “nominal accounts”) include all of the revenue accounts, expense accounts, the owner’s drawing account, and the income summary account. Generally speaking, the balances in temporary accounts increase throughout the accounting year. All income statement accounts with credit balances are debited to bring them to zero. Debits increase asset and expense accounts, and decrease revenue, liability and shareholders’ equity accounts. A sales journal entry is a bookkeeping record of any sale made to a customer.

Cost of Goods Sold has a normal debit balance because it is an expense. The contra revenue account has a debit balance since it is subtracted from the sales revenue account. When sales are returned by customers or an allowance is granted to them due to delayed delivery, breakage, or quality issues, an entry is made in the sales returns and allowances journal. Let’s consider a practical example of a sales revenue journal entry in accounting, focusing on both a cash sale and a credit sale scenario. Identifying which products contribute to sales returns and allowances and addressing the underlying problems can minimize deductions from sales. A sales transaction is the most important type of transaction in any business because it provides the cash that pays for all business expenses and is the source of profits.

All of our content is based on objective analysis, and the opinions are our own. The original memo is sent to the customer and the duplicate copy is retained. Here is the entry to recognize inventory and derecognition of the cost of goods sold. These inventory/goods need to be stored and recorded in the warehouse.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. The following are some selected transactions performed by Maria Trading Company during the month of January, 2018.

The format of the sales returns and allowances journal is shown below. On Feb 5, journal entry to record the sales return and the buyer’s account adjustment. It depends on whether the sale of those goods that were returned were cash sales or credit sales. In recording a journal entry for sales, you’ll need to pass entry for sales—that is, move the information to all of the different accounts where it needs to be recorded.

Содержимое BETKOM Casino’ya Nasıl Girilir? 1. BET […]

เทศบาลนครนครศรีธรรมราช เปิดถนนศิรินครอุทิศ วันศุกร์ ที่ […]

Содержимое 1win – Онлайн казино и БК Украины Уник […]

Содержимое Was ist OnlyFans? Wer nutzt OnlyFans? Wie fu […]